A deep understanding of bank microservices architecture

The needs of its clients and the market are changing rapidly, and banks are finding it difficult to keep up. Although it’s difficult to adopt, microservices architecture may assist banks in overcoming many of these difficulties. The bank microservices architecture is a tried-and-true solution to these problems.

What is bank microservices architecture?

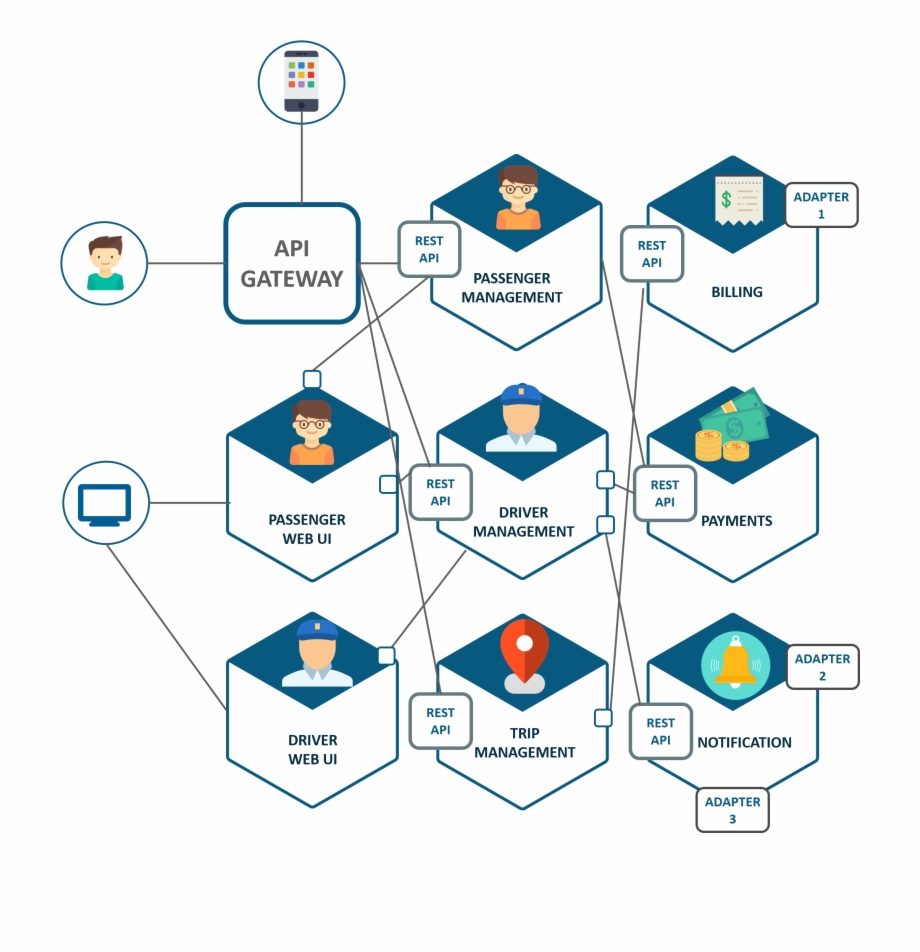

Software developers design an application as a collection of discrete, loosely linked services, each built around a specific function or feature, such as email management, data analytics, or reporting.

This architectural paradigm is known as microservices architecture. Lightweight synchronous protocols like HTTP/REST or asynchronous protocols like AMQP are used by these services to connect with one another.

- Services may be created utilizing a variety of technologies, including databases, frameworks, and computer languages.

- Each service may be independently developed, deployed, maintained, and scaled. As a result, while adding new features or making small adjustments, the whole banking system does not need to be upgraded or rewritten.

- Software professionals may break down a component service into smaller services to increase scalability and maintenance if they expand it and make it more complicated.

The advantages of a bank microservices architecture

Scalability

While managing an increasing number of users and demands, banking software solutions often have to provide services to thousands of consumers. Users may experience typical concerns such as performance issues, downtime, and errors when the system is not scalable.

To beat rivals and attract customers, financial organizations must also roll out new products and upgrades quickly. With a monolithic program, this is a difficult process. Additionally, it could be hard to expand a software product built on top of an outdated technological stack.

This makes it simple for software developers to provide automatic scalability of computer resources in response to demand fluctuations throughout the day.

Smartosc solutions : BACKBASE DIGITAL BANKING, BUY NOW PAY LATER, LOS, CDP, EKYC, DIGITAL ONBOARDING

Fault tolerance and system integration

Another benefit of microservices design is high availability, which is necessary for prompt service delivery. Because of the loose coupling and flexibility that define bank microservices architecture, users may continue to interact with software even in the event of a malfunction.

A fault-tolerant software system will also continue to function even under extreme loads, such as those that result from a web platform having to handle millions of requests or massive amounts of data at once.

Simplicity of upkeep

Financial services organizations may greatly simplify infrastructure maintenance using a bank microservices architecture, which also lowers infrastructure expenses. Services may be maintained independently of one another as long as they are autonomous, loosely connected, and tiny.

As a result, adding new features and making modifications to a module are more simple for banking software developers. In contrast, developers often have to rebuild a significant portion of the coding in a monolithic program, which takes time and more work.

The adaptability of using various technology stacks

Financial organizations that deal with extremely sensitive information, such as user personal information, transactional information, and billing information, must ensure data privacy and compliance.

Organizations may enhance security and simplify compliance by using bank microservices architecture applications. For instance, owing to loose coupling, if potential problems are found in one module, software professionals may focus all of their efforts on fixing them as soon as feasible without affecting the remainder of the system.

Enabled deployment

Bank microservices architecture solutions allow for the autonomous deployment of individual components, eliminating the need to completely reinstall the software platform whenever new features are added by developers.

Therefore, banking businesses may save costs and time while boosting productivity by automating the deployment process.

Banks have embraced the bank microservices architecture to improve scalability and agility. SmartOSC can assist you if you want to implement a microservices architecture at your own bank or financial institution. Let SmartOSC assist you in developing an agile and scalable banking system so you may compete effectively and provide the finest services to your clients.