Did you know that leading digital banking have these features?

It may be challenging to manage your money, particularly if you’re working by yourself. It might be challenging to monitor your expenditures and make sure you aren’t going overboard each month. SmartOSC provides a range of digital banking features because we recognize that keeping track of your finances may be challenging.

Customer-centered approach

Each digital banking features should be built on enhancing the customer experience. This will result in the long-awaited increase in client loyalty. Any digital service and product implementations must be “smart, responsive, and customer-tailored.”

This new approach has to incorporate all departments, not just marketing or innovation but also the regulatory and legal teams. The refinement of a solution results from the search for one in diverse teams.

Consider behaves as a further adversary and new business concepts

Startups in the financial technology sector are prospering and leading the way in the development of new financial services and digital banking features. How can you out-compete them?

Bank encourages accelerated innovation, embracing the technology “revolution,” and adopting the mindset that is helping these new firms succeed. Traditional banks need to consider what their lucrative streams of revenue would be if they were a fintech company. and engage them on a significant scale.

Competition and cooperation

The competitiveness of both these startups and conventional banks will increase with the creation or promotion of shared platforms. The fact that numerous huge institutions have already chosen this path and are gradually opening their doors to startup businesses serves as confirmation.

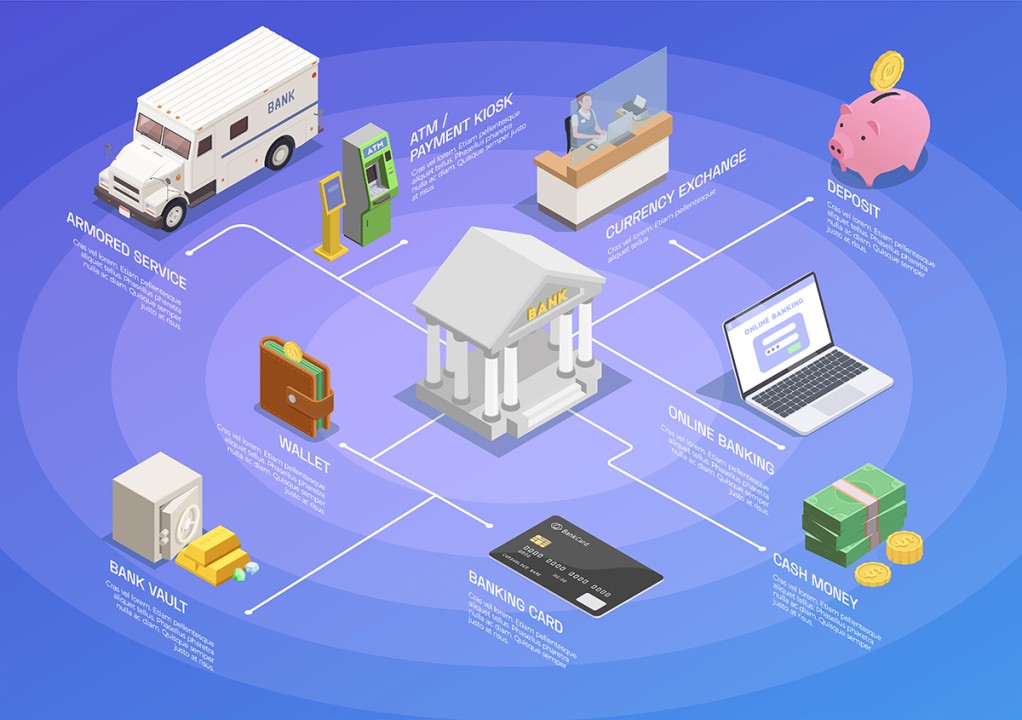

Smartosc solutions : BACKBASE DIGITAL BANKING, BUY NOW PAY LATER, LOS, CDP, EKYC, DIGITAL ONBOARDING

Another important pillar in the process of digital banking features is collaboration. In order to enhance the services and goods that are eventually offered to the end consumer, several fintech firms are requesting a more collaborative approach from more established financial institutions.

Engaging in fintech startup work

In this regard, connected to the characteristic above, many institutions are working on initiatives in collaboration with the most creative companies or even purchasing them.

They pick up new business practices and financial service delivery methods from these businesses, which helps them stay competitive.

Some of the work involved in creating new goods or services for both the present and the future of digital banking features should be outsourced. They are, in particular, solutions created and modeled after the experiences of new digital users.

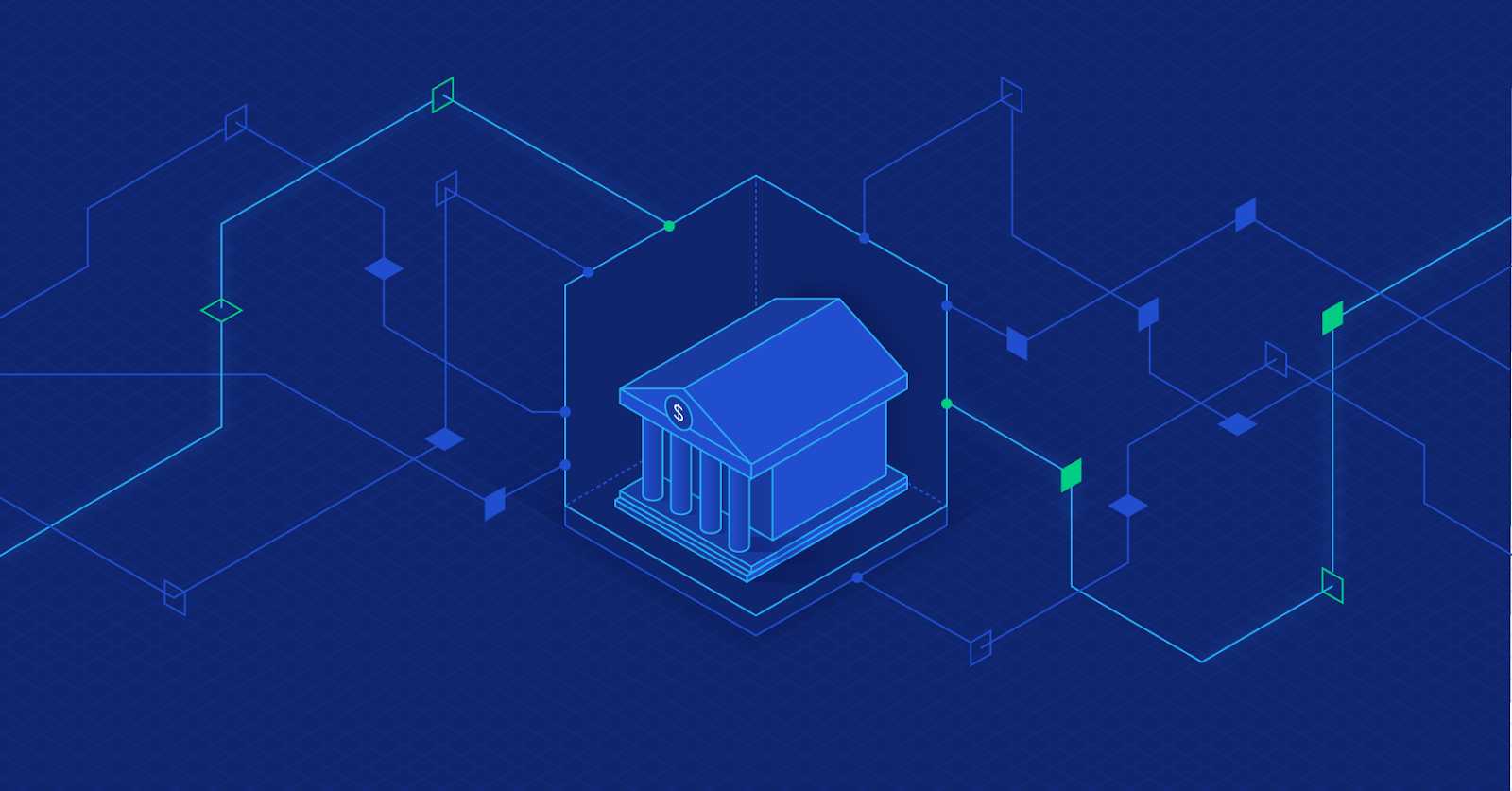

Building an open IT architecture

The sixth need for a bank’s digital transformation is that it be open to new partners and outside parties. This is the so-called open innovation process, which draws on the expertise of others and reciprocally shares that knowledge with others. As a result, everyone involved in the process becomes more responsive.

API platforms are used to provide scalable solutions, increased consumer engagement, and more consistent omnichannel experiences.

Responsiveness in innovation planning

The digital banking features must be ongoing, i.e. always developing, despite the seeming contradiction, in order to keep up with all the advances that take place both within and outside the financial industry.

Efficiency in “learning, acting, and reacting,” or adapting to new developments, is one of the characteristics that has to be improved. The innovation labs that are being deployed in many banks can’t be a one-time thing; they need to have an influence on every division of the business.

Taking down divisional barriers

The first point is developed, but one of the characteristics of modern digital banking will be the organizational level change. One necessity for the process to be effective is to promote the formation of teams that comprise the previously segregated departments.

One of the cornerstones of digital banking features is cross knowledge, which encourages responsiveness in corporate operations and in attempts to develop, introduce, or enhance a product or service.

SmartOSC hopes that after reading this, you have a better idea of the many digital banking features you have and how they could help your company. Please don’t hesitate to get in touch with us if you have any questions or would like assistance learning about digital banking. In addition to helping you set up with the tools you need to advance your company’s finances, our staff is pleased to answer any queries you may have. Gratitude for reading!