Loan application fraud detection with latest technologies

The number of fraudulent incidents involving identity theft, data breaches, and payment fraud is rising along with the use of e-banking and digital payment applications. With the latest tech, SmartOSC will now provide loan application fraud.

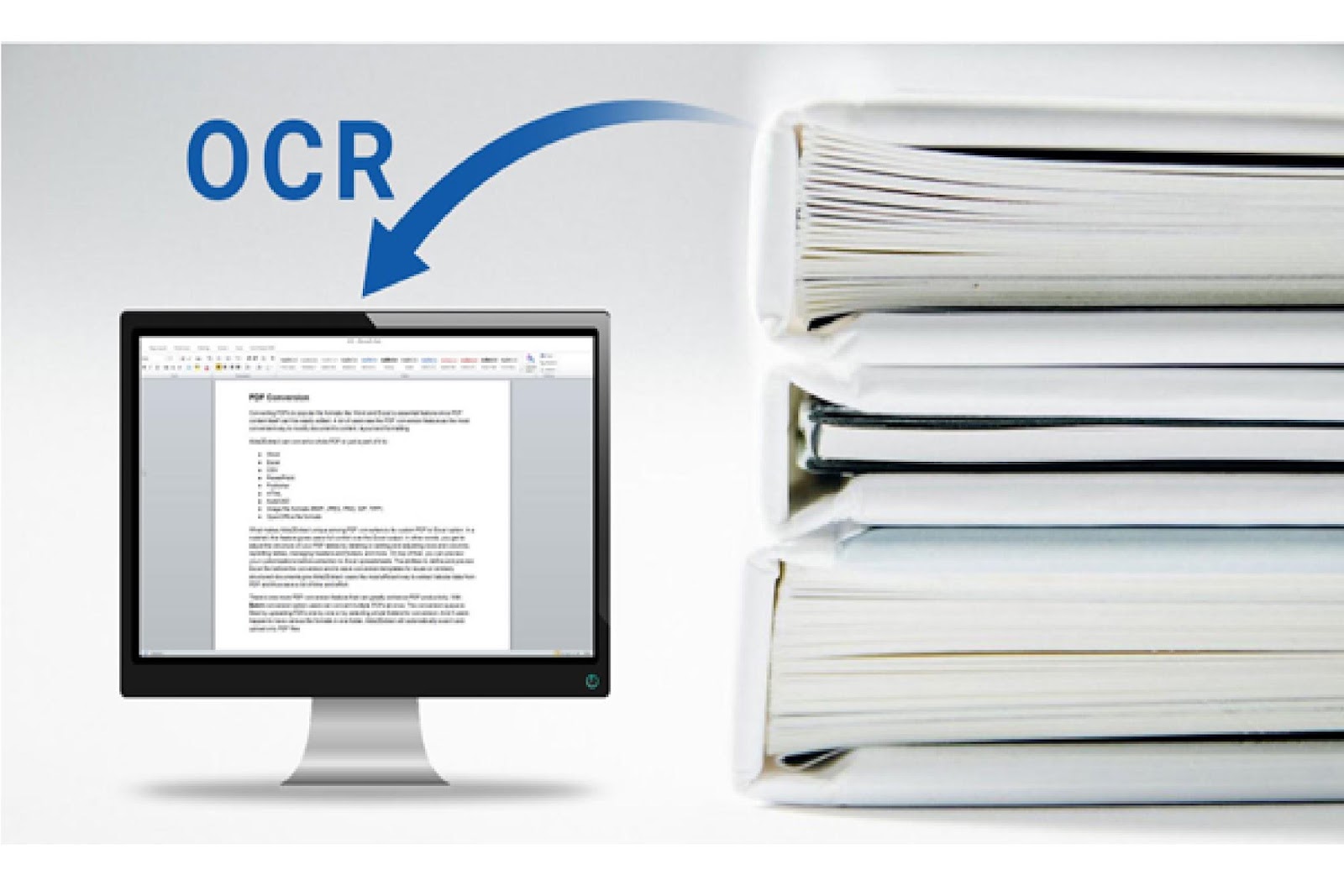

OCR

Since its invention in the 1990s, optical character recognition (OCR) technology has found extensive use in a variety of crucial industries all over the globe. One of the biggest industries using OCR automation technology nowadays prevents loan application fraud.

Utilizing OCR in banks has sparked a rapid and widespread revolution in document digitization, lightening the burden on a substantial amount of administrative labor.

The eKYC procedure incorporates OCR technology. Extract data from identification documents including passports, ID cards, and licenses, then upload the encrypted data to the system. The whole procedure, from data extraction to metric generation, is totally automated and has a 99.9% accuracy rate. It takes no more than 3 seconds.

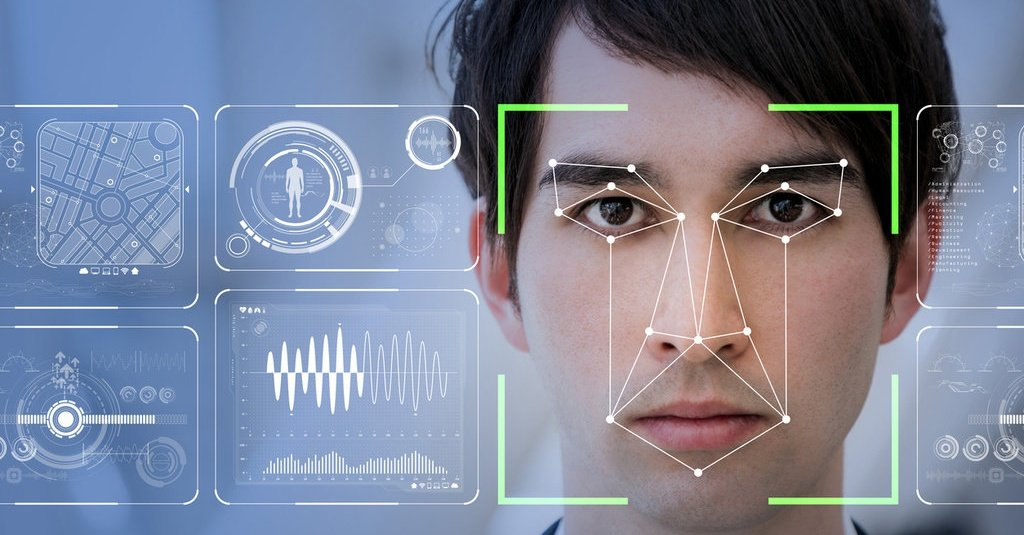

Face matching

Face matching is a technique for utilizing a person’s face to identify or confirm their identification. People may be recognized using this technique in loan application fraud, on camera, or through pictures.

Computer algorithms are used by face matching systems to identify certain features on a person’s face. The information is then converted to digital form and compared to information on other faces gathered in a facial recognition database, such as the separation between the eyes’ distance or the contour of the chin.

Smartosc solutions : BACKBASE DIGITAL BANKING, BUY NOW PAY LATER, LOS, CDP, EKYC, DIGITAL ONBOARDING

A face pattern is information about a specific face that varies from a picture in that it is intended to include loan application fraud elements that may be used to differentiate this face from others.

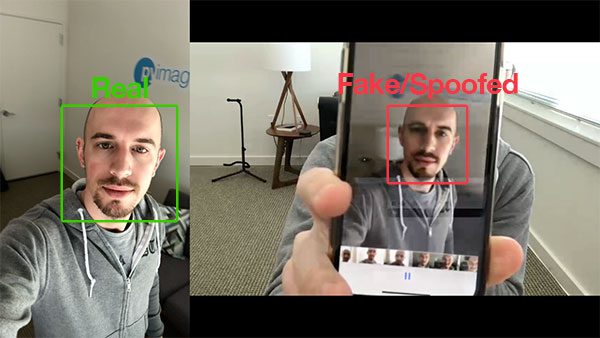

Liveness Detection

Liveness detection technology helps prevent attacks and identity theft because it determines in real time that the biometric confirmation is genuine, not a forgery – a feature designed to be effective. high efficiency with which users can interact with loan application fraud systems.

At Innotech, it’s very easy to use and only requires selfie photos/videos, taken via the user’s webcam or smartphone/tablet camera:

Live-recorded images/videos are analyzed to ensure vibrancy and prevent image/video playback and other presentation attacks.

A photo of an ID card, passport, or driver’s license, compared with a live photo (Face matching).

E-Signature

Legally obtaining permission or approval on electronic documents or forms requires an electronic signature. In nearly every procedure, it may take the place of a handwritten signature.

For straightforward activities like creating a new bank account, electronic signatures provide banks with a competitive edge. Customers are given the option to complete loan application fraud at the branch from the convenience of their computer or mobile device, regardless of where they are, and without having to sign any paper forms.

Instead of taking days, bank accounts may be established immediately. Customers may electronically sign any kind of document using a tablet or smartphone, and they will immediately get a copy of the signed document through email.

The application of eKYC solution to lending also helps financial institutions – Banks do not have to spend much time and minimize errors due to filling in and comparing information provided by customers. Because the damage caused by loan application fraud is extremely. Please contact SmartOSC to access our consultation page if you need emergency help; we will get in touch with you right away.