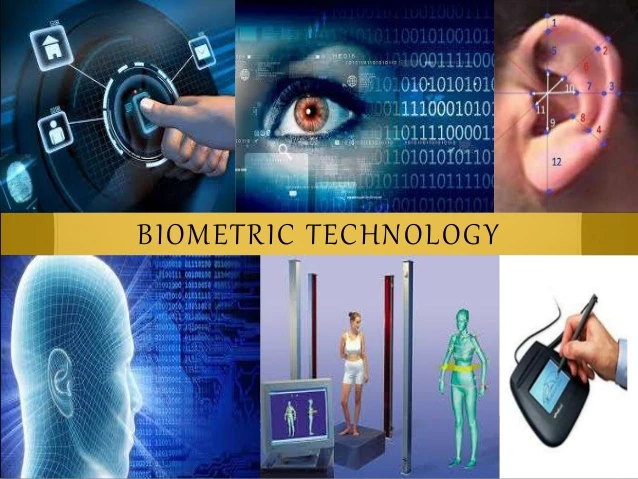

Enhancing security is a top goal in the digital banking sector to protect user data and assets against fraud and hackers. One particularly successful approach that banks have created to increase the security of digital banks is the use of biometric technology for identification and speeding up transactions.

Passwords and PINs are examples of conventional identifying techniques that may be vulnerable to counterfeiting. The banking sector is currently utilizing biometric technologies to address these issues and improve the customer experience while conducting transactions and confirming identification.

Since Apple released the Touch ID and Face ID features, mobile biometrics have become extensively utilized. The bulk of smartphone users then starts to use this technology more and more.

Here are some examples of how biometric technology is used in the world of online banking:

When consumers can do such quick transactions without having to memorize complicated passwords, it offers the utmost convenience. Currently, many banks use biometric technology (most often fingerprints) as an alternative to passwords for identification.

One of the most popular forms of biometric technology used in smartphones and other devices is fingerprint recognition. Every person has a unique fingerprint pattern, even identical twins, which is why the bulk of the industry, including digital banking, incorporates fingerprint identification into its systems.

Smartosc solutions : BACKBASE DIGITAL BANKING, BUY NOW PAY LATER, LOS, CDP, EKYC, DIGITAL ONBOARDING

The biometric software often analyzes a fingerprint’s minute details before scanning its characteristics, such as orientation, arches, loops, swirls, ridges, or even pores. The software system stores this feature data so it may later use them to confirm a person’s identification.

Users must update their passwords on a regular basis, often every three months, according to the security regulations of various institutions.

Therefore, digital banks that incorporate fingerprint recognition technologies with an uncomplicated setup procedure would boost convenience along with the user’s experience rather than forcing them to remember the current passwords.

Voice recognition has gained popularity across a variety of sectors due to the rise of voice assistants like SIRI by Apple and Cortana by Microsoft, and the banking industry is no different.

Voice identification uses the distinctive qualities of a person’s voice, such as tone, pronouncing patterns, and audio quality, to set them apart from others. To save time reading accessible phrases, the voice recognition systems will first record the voices of their employees or customers during a typical discussion.

With this biometric technology, you may continue working while placing orders, carrying out transactions, verifying attendance, or logging into bank accounts using only your voice.

The next level of banking security is regarded as biometric face recognition. Previously, the Face ID features of Apple’s iPhone X were the most well-known application of this technology.

Face recognition uses a variety of sophisticated and cutting-edge technologies, including 3D sensors and software algorithms, to identify facial traits that match those of a face that has comparable characteristics in systems, such as eye and lip shape and color, as well as their placement.

Banks are able to create innovative, highly secure, and convenient methods of authentication and automatic transaction making with the use of biometric technology. To learn more about fintech technology, contact SmartOSC Fintech or stay up to date with our site for more useful articles.

Retail banking has come a long way since its inception. In the current age of…

Integrated banking technology has revolutionized the banking industry, offering many benefits that are changing how…

In the highly competitive banking industry, customer relationship management (CRM) has become a critical component…

As the banking industry evolves, customers demand more convenient and flexible banking services. This has…

Banking software has revolutionized the financial industry, enabling financial institutions to serve customers more efficiently…

Bank strategy consultant As the banking industry evolves rapidly, financial institutions must stay ahead of…