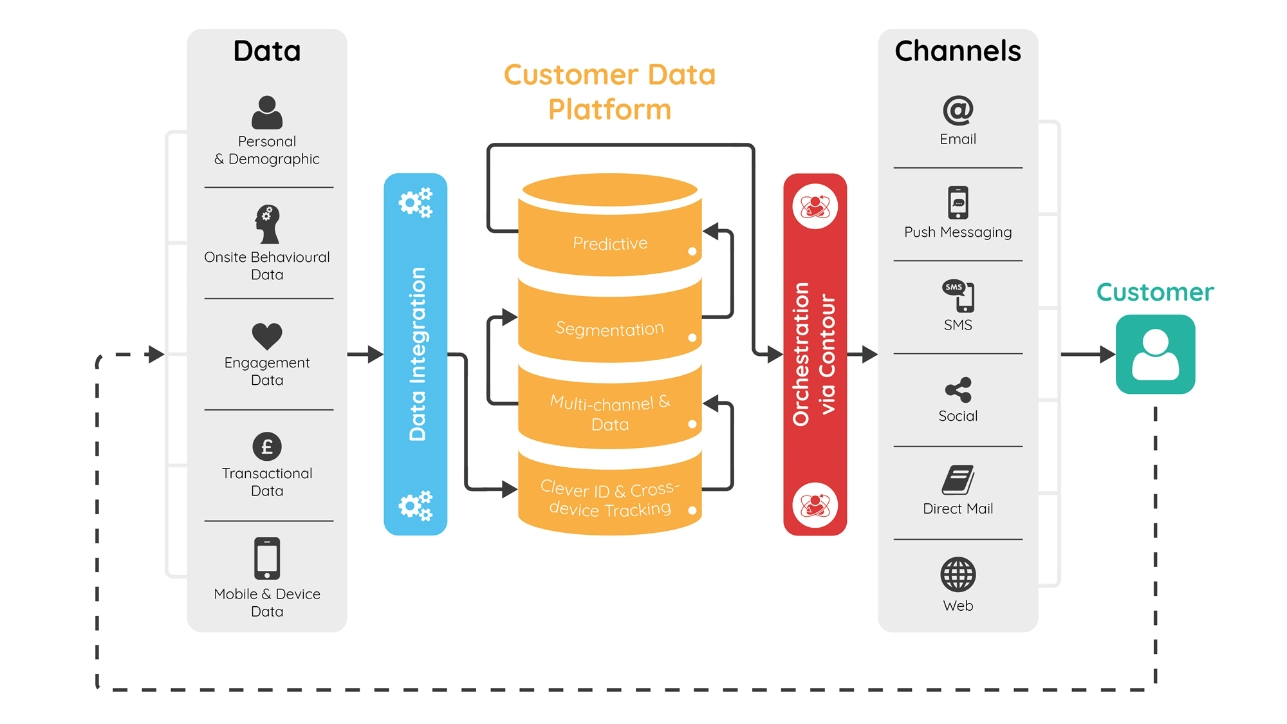

Digital technology, data, and insights are integrated throughout the whole value chain in a digital bank, from systems of innovation that promote client involvement to systems of record that offer the basic applications all the way to systems of control. SmartOSC Fintech will demonstrate the ideal customer data platform architecture for banks in this post.

The core capability, which is the foundation of your customer data platform architecture digital bank, allows you to spread data across your organization to feed both your operational and analytical features and processes.

It is also known as the data fabric, mesh, or whatever the current buzzword is. The transition to event-based architectures and streaming data represents the true paradigm change that I have seen in successful digital banks.

This trend is well established in non-financial services organizations, and it is a potent capacity that creates many potentials for cutting-edge client features, such as continuous monitoring of customer behavior and risks and real-time notifications, warnings, nudges, and recommendations.

The industry today mandates that new digital banks be built on a microservices architecture; otherwise, they won’t be able to accommodate the rate of customer data platform architecture. Since most microservices will need to manage state and store data within this well-established model, here is where the ODS can really shine.

Your microservices’ data storage is provided by the ODS. The ODS will really consist of numerous distinct databases, each of which will be controlled by a different microservice. Since each microservice may have different storage needs, read/write patterns, and technological requirements, this calls for a well considered architecture.

Smartosc solutions : BACKBASE DIGITAL BANKING, BUY NOW PAY LATER, LOS, CDP, EKYC, DIGITAL ONBOARDING

Your data lake should contain all of your data, including structured and unstructured data from voice conversations, web chats, clickstreams, social media, and third parties (e.g. example accounting data, or bureau data).

This data-rich environment may then be used for exploration, innovation, and ideation since it dismantles legacy silos and makes it possible to find new connections and insights. Your data scientists, marketing teams, and customer experience analysts should spend their time there developing ML models, finding opportunities for new revenue streams, and influencing business choices.

It’s one of the most important customer data platform architecture resources, and if managed properly, it may give your digital bank the potential for substantial uniqueness and competitive advantage.

Everyone has their own horror stories concerning data warehouses, and these stories undoubtedly of customer data platform architecture have a bad reputation, largely since so many early 2000s ventures ended up failing. However, the DW concept continues to play a significant part in the current digital architecture.

The data warehouse allows you to provide transparency and full lineage on your data, which is essential for regulatory, risk, and financial reporting, such as BCBS, MIFID, COREP, FINREP, BOE, etc. The data warehouse is required to deliver consistent, repeatable, high quality, and highly governed MI and reporting.

The DW will make you fall in love with customer data platform architecture once more and provide commercial value if used in this constrained manner.

The banks that have the proper customer data platform architecture to unlock the value of their data will succeed in the coming decade as all banks become more data-centric. The miniseries analyze the growing significance of data in digital banking and the analytics and AI it enables. Contact SmartOSC Fintech for additional information about fintech, or visit our website frequently for new, helpful content.

Retail banking has come a long way since its inception. In the current age of…

Integrated banking technology has revolutionized the banking industry, offering many benefits that are changing how…

In the highly competitive banking industry, customer relationship management (CRM) has become a critical component…

As the banking industry evolves, customers demand more convenient and flexible banking services. This has…

Banking software has revolutionized the financial industry, enabling financial institutions to serve customers more efficiently…

Bank strategy consultant As the banking industry evolves rapidly, financial institutions must stay ahead of…