White-labeling offers total control over branding and customer experience, as well as a high degree of control over aspects of manufacturing, price, and profitability, giving companies the chance to investigate new revenue streams. Even better, it provides a finished product for new businesses to customize and make their own.

Banks may view cutting-edge white label digital banking products in this article from SMARTOSC Fintech.

White labeling refers to the practice of businesses marketing goods that were made by a third party under their own label or brand. It occurs all over. You might not be aware when you come across white-label goods, but you shouldn’t be. That is the entire point.

White-labeling, also known as private-labeling, offers businesses the chance to develop completely unique client experiences without having to go through the laborious process of, you know, developing new items.

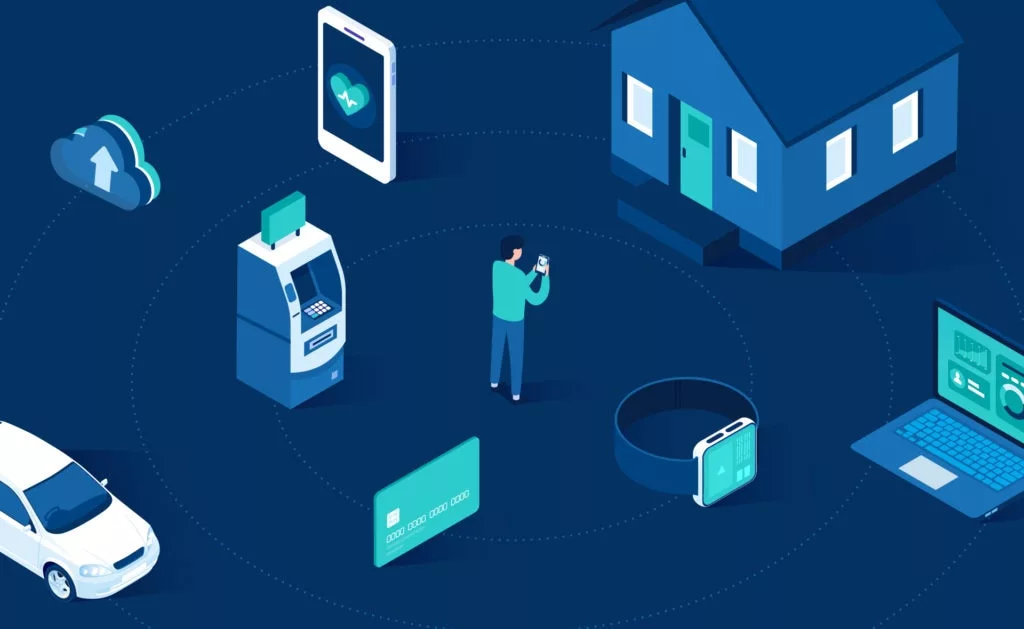

What exactly is a white label bank, then? A white label digital banking is a provider of Banking as a Service (BaaS) that constructs its own financial products on the infrastructure of a licensed bank by using the bank’s application programming interfaces (APIs).

Consider any completed item. Really, just do it! Even though we’ll discuss fintechs in a moment, it might also be a clothing brand or a range of cosmetics. Honestly, almost anything. Imagine dipping the completed item into a large bucket of white paint at this point.

Giải pháp của SmartOSC Fintech BACKBASE DIGITAL BANKING, BUY NOW PAY LATER, LOS, CDP, EKYC, DIGITAL ONBOARDING

Use flexible contracts and pricing schemes to attract and keep consumers. The higher customer of white label digital banking and other operations’ costs will help banks draw in the target audience and enhance their profit.

Utilize infinitely configurable trading fees and limitations to efficiently monetize each client group. Create pricing schemes with distinct costs and restrictions for every type of white label digital banking. Achieve the ideal balance between their customers’ maximum value and their company’s earnings.

Have complete information about each client on hand, including login history, conflicts, and operations history. By promptly addressing issues and anticipating customers’ demands, you may exceed expectations and increase sales.

The admin portion of the white label digital banking platform will be adored by the staff since it has an easy-to-use user interface, a practical analytics dashboard, and automation for repetitive work.

Gain visual insights into the operation of white label digital banking, identify areas that require attention right now, and identify new prospects. To ensure speedier and more efficient growth, gather data on every aspect of the organization.

Build solutions for fraud protection, anomaly detection, business forecasting, etc. on top of the data warehouse infrastructure within the system by utilizing the ML-ready architecture of the white label bank solution.

White label digital banking is particularly common in the retail sector, as big shops frequently slap their own name on a product or do so with great care. For assistance in developing a whole new product in order to create wholly new consumer experiences, companies frequently even turn to outside producers. If you have any inquiries or problems, don’t be afraid to contact SMARTOSC Fintech.

Retail banking has come a long way since its inception. In the current age of…

Integrated banking technology has revolutionized the banking industry, offering many benefits that are changing how…

In the highly competitive banking industry, customer relationship management (CRM) has become a critical component…

As the banking industry evolves, customers demand more convenient and flexible banking services. This has…

Banking software has revolutionized the financial industry, enabling financial institutions to serve customers more efficiently…

Bank strategy consultant As the banking industry evolves rapidly, financial institutions must stay ahead of…