Anatomy of a leading mobile banking app

Powerful mobile application technologies enable us to conduct almost all of the same tasks on the go as we would on a desktop computer. All throughout the world, banks and other financial institutions are turning mobile.

Six elements that a successful mobile banking app must have been covered in this article. Let’s get started straight away, shall we?

Management of Bank Accounts

Installing a mobile banking app is intended just for managing bank account information remotely from a mobile device.

Users may keep track of their credit cards and bank accounts, check balances, examine transaction histories, and transfer money at any time, anywhere by using features that allow for bank account administration.

You could also make categories for things like entertainment, eating, online shopping, etc. to track what you spend the most money on. By doing so, you may determine if your budgeting routine is working and whether you need to make any adjustments to achieve your objectives.

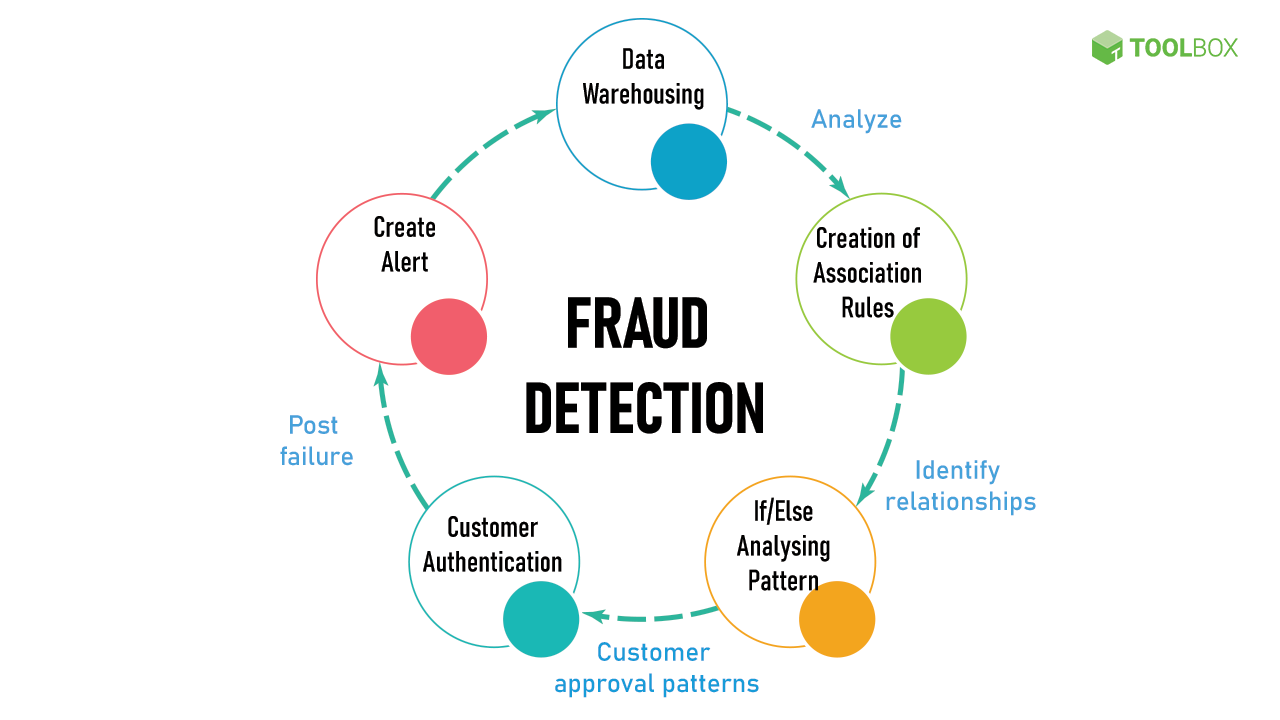

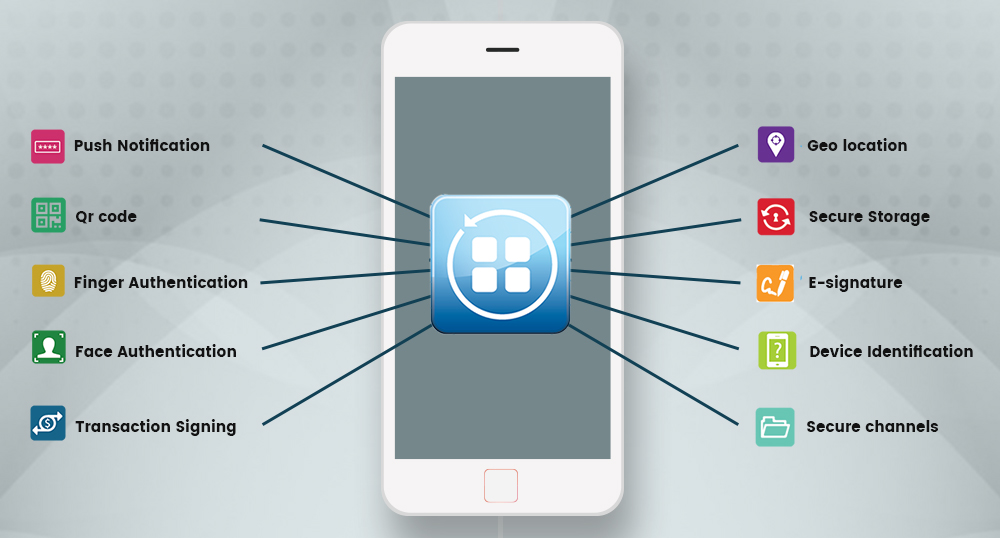

Advanced Security & Fraud Alerts

These days, you can never be too cautious. Users demand the strongest possible security against hackers and cybercrime when it comes to sensitive data.

Giải pháp của SmartOSC Fintech BACKBASE DIGITAL BANKING, BUY NOW PAY LATER, LOS, CDP, EKYC, DIGITAL ONBOARDING

You must first make sure that the app has the secure sign-in capability if you want to have a successful mobile banking app. Without introducing too many steps that can annoy customers, you want to ensure that there are precise processes needed to sign in to a user’s online banking account.

To stop fraud, systems watch thousands of transactions every second. The user is the first to be alerted if any questionable behavior is found.

Banking CORE Features

A back-end technology called CORE banking, or centralized online real-time exchange banking, quickly processes transactions and uploads changes.

The mobile banking app has made a variety of services accessible via various digital platforms.

Retail banking, wholesale banking, or securities trading may all be supported by CORE banking software. Several of the features of service-oriented CORE banking include the following:

- Enrolment for new accounts and administration of current accounts

- Transfers and deposits

- Managing loans

- Calculating interest rates

- Management of customer relationships (CRM)

- The disclosure of new financial products

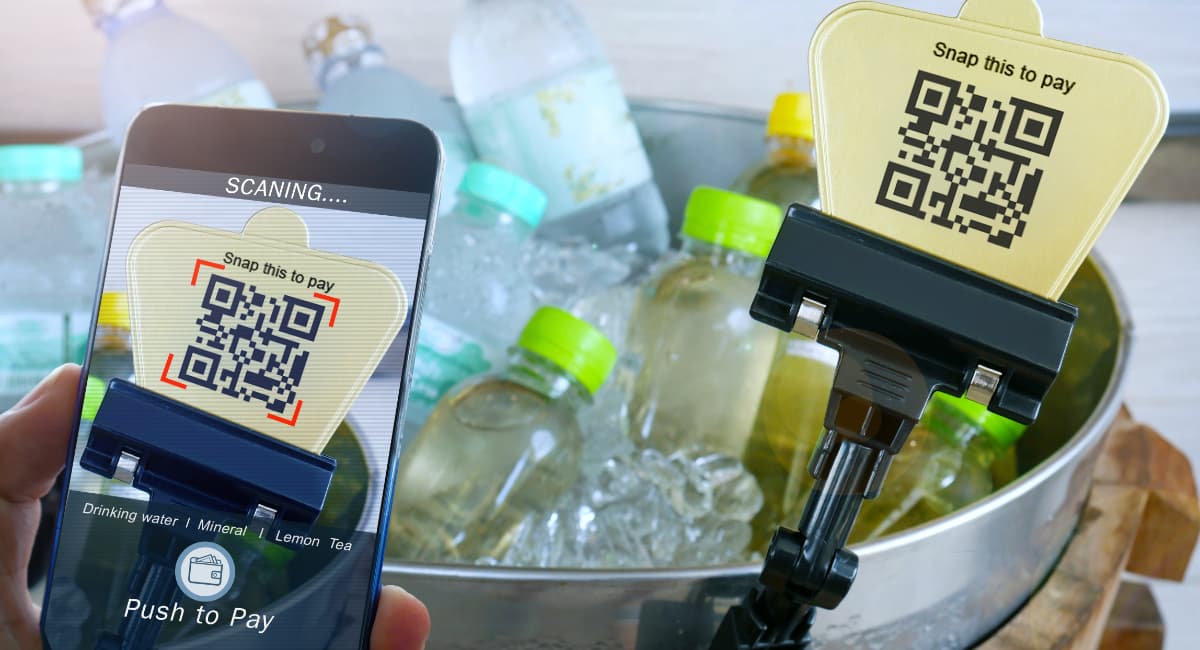

Paying using a QR Code

Mobile applications are increasingly using QR codes, which allow customers to rapidly and contactless make transactions by scanning their codes with a barcode reader.

Leading banks are already incorporating QR code scanning technology into their mobile banking app to take advantage of the QR code frenzy.

Both issuers and retailers may greatly increase the number of mobile payment methods available to their clients by using QR codes. Customers like the simplicity, convenience, and added security that QR code payment systems provide.

Check deposits on the go

For those who still bank in an old-fashioned manner, this function could seem like something out of a science fiction novel. Customers all across the world, however, are becoming more and more used to utilizing it.

Time is saved, which is the most obvious advantage. Users don’t need to drive to the credit union or bank branch and wait in line for a teller to become available in order to deposit a check.

Endorsing the check and taking front and rear pictures on your mobile banking app just takes a few seconds. The deposit information is sent to your account, and the money is often available the following day.

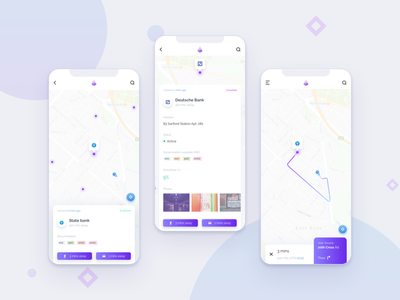

ATM Locator

It could appear really simple to include an ATM locate function in your banking app. Keep in mind that certain applications are more popular than others because of the details.

Customers should be able to rely on your banking app to find the closest ATM when they need to. This functionality is included in the majority of mobile banking applications not because it is the norm but rather because users want it.

By all means, feel free to use your banking app for whatever you choose. But don’t forget the necessities, like the ATM locator tool.

Whether you want to hire a couple of our skilled developers to supplement your current IT staff and increase the potential of your banking app, or you need a brand-new mobile banking app created from the start, SmartOSC has you covered.