Your competitors might already adopting these fintech trends

Fintech is a rapidly developing phenomenon that has the potential to upend many aspects of the financial industry. Everyone is talking about fintech in the banking industry. From payments to consulting services, it has transformed several financial sector companies.

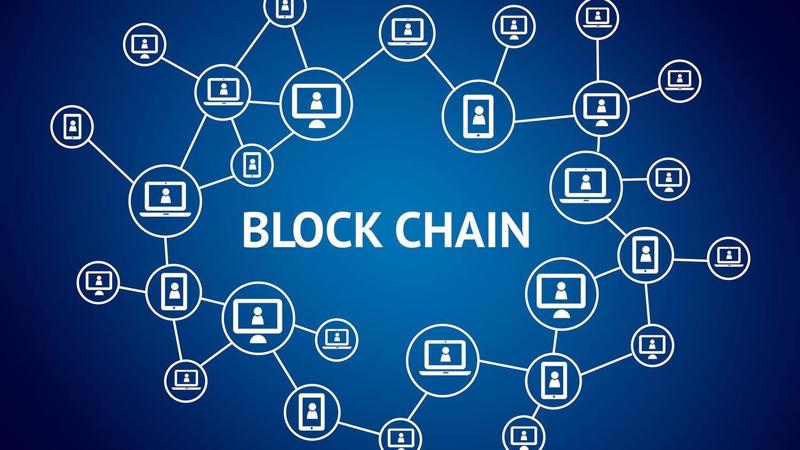

Blockchain

The infrastructure of the digital world is increasingly being driven by distributed ledger technologies. It is the technology that underpins Bitcoin and other cryptocurrencies, but it also has a wide range of additional uses.

NFTs and decentralized finance (Defi) are only two examples of how blockchain might alter the financial industry. There are innumerable further applications for this technology, making it challenging to foresee what fresh innovations may emerge in these fields over the coming few years.

Before blockchain is used more widely in fintech trends, there are still a number of obstacles that must be addressed.

Sensors and the Internet of Things (IoT)

The way financial services function and how we see data are both changing as a result of the Internet of Things. The fintech revolution typically includes sensors in its description. These sensors, which are being used more and more often, enable businesses to gather data unlike ever before.

Smartosc solutions : BACKBASE DIGITAL BANKING, BUY NOW PAY LATER, LOS, CDP, EKYC, DIGITAL ONBOARDING

According to a Harvard University study, “the capacity to install low-cost sensors to track the temperature, position, and stress of nearly any moving element” opens up vast possibilities for monitoring distant activities, whether simple household gadgets or major capital equipment.”

ATM machines are one example of fintech trends being utilized in the financial services sector. These machines can tell how many people are waiting in line to use them.

Mobile Payments and Digital Banking Services

One of the most well-known fintech trends upending traditional banking is neo banking. Neobanks are a new class of bank that exclusively operates online and were designed with mobile users in mind.

Instead of traveling to a real branch or completing a ton of paper documentation, customers may create an account with an app on their smartphone.

These apps have a friendlier user experience, and the majority of them provide a wide variety of financial services, such as savings accounts, mortgages or vehicle loans, as well as simple payments and transfers.

Augmented Reality / Virtual Reality (AR/VR)

People may now buy stocks or trade currencies using virtual reality, which is steadily making its way onto the market for financial technology use cases. It offers an immersive experience to quickly make financial decisions and track real-time market fluctuations.

It serves as a great illustration of how investors may employ fintech and contemporary technologies. Fintech is quite likely to play a crucial part in such large-scale fintech trends.

Although the majority of experts concur that it will be some years before VR has further practical applications, businesses are already experimenting with the technology to uncover its potential.

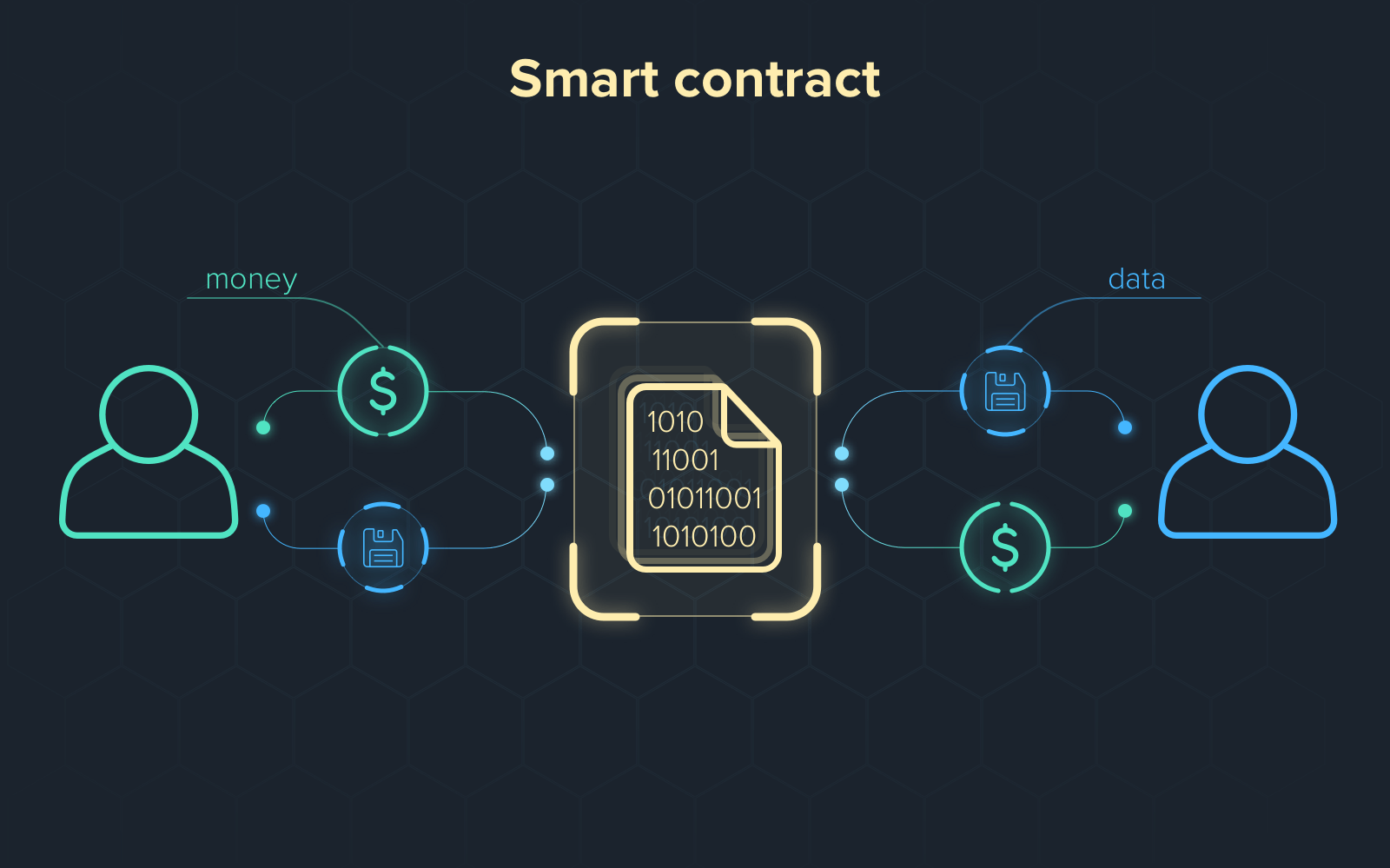

Smart Contracts

Even though their full potential hasn’t yet been realized, smart contracts have a lot to offer the financial services sector: greater security (e.g., removing third parties), higher efficiency (faster transactions and lower prices), better transparency (raising accountability), and lower fees (eliminating overhead costs).

Compound Finance is one example of smart contract-based fintech trends that enables customers to take out a short-term loan with Ether as security. Agrello is another firm that makes use of smart contracts; it seeks to create smart contracts for enterprise clients that go into effect when specific circumstances are satisfied.

Fintech is a sector that is rapidly changing, with new trends emerging every year. By making informed business decisions for the future expansion of your company, you may get fresh insights and stay one step ahead of the competition by learning about these top five fintech trends.

Follow us for more insightful articles, and get in touch with SmartOSC Fintech for more information on fintech technologies.