The Frugal Guide to trade finance technology

The globalization of the financial services and industry in recent years has strengthened its foundation and drawn individuals to upgrade their old methods of financial use by using trade finance technology.

Cash-in-Advance

An exporter may avoid credit risk using cash-in-advance payment arrangements since money is paid before ownership of the products is changed. Wire transfers and credit cards are the most popular forms of cash-in-advance offered to exporters for foreign sales.

The least appealing alternative for the buyer, nevertheless, is to demand payment in advance since it results in a poor cash flow. Foreign purchasers worry that if payment is made in advance, the items could not be delivered.

Exporters that insist on using this type of trade finance technology as their exclusive means of doing business risk losing out to rivals who offer more enticing payment terms.

Letters of Credit

One of the safest tools accessible to global merchants is the letter of credit (LC). An LC is a promise issued by a bank on behalf of the buyer that the exporter will be paid as long as all of the requirements outlined in the LC have been satisfied and have been validated via the presentation of the necessary documentation.

To get this service, the buyer obtains credit and pays his or her bank. An LC is helpful when a foreign buyer’s credit information is hard to come by but the exporter is confident in the buyer’s foreign bank’s creditworthiness.

Giải pháp của SmartOSC Fintech BACKBASE DIGITAL BANKING, BUY NOW PAY LATER, LOS, CDP, EKYC, DIGITAL ONBOARDING

A LC, one trade finance technology, also protects the customer since there is no financial commitment until the items are delivered as promised.

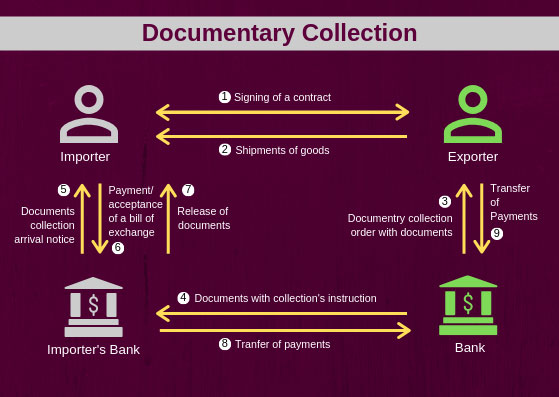

Documentary Collections

In a documentary collection (D/C), the exporter gives control of trade finance technology for a sale to its bank (the remitting bank), which then gives the buyer’s bank (the collecting bank) instructions to transfer the necessary papers to the buyer for payment.

The collection letter contains instructions that include the paperwork needed to transfer ownership of the items. Although banks do serve as intermediaries for their customers, D/Cs provide no means of verification and just a few options in the case of non-payment.

Open Account

Since the provision of credit by the seller to the buyer is more frequent abroad, foreign buyers often demand exporters for open account conditions due to the fierce competition about trade finance technology in export markets.

As a result, exporters who are hesitant to issue loans risk losing a sale to rivals. By using one or more of the suitable trade financing approaches discussed later in this Guide, exporters may provide open account terms that are competitive while significantly reducing the risk of non-payment.

Consignment

Consignment is a kind of trade finance technology used in international commerce, however, payment to the exporter is not made until the products have been sold by the foreign distributor to the final consumer.

Exporting products on consignment is highly dangerous since the exporter is not guaranteed to receive payment and because the commodities are in the hands of an independent distributor or agency in a foreign nation.

Consignment increases exporters’ competitiveness since items are more readily available and delivered more quickly. Exporters may save their direct inventory management and storage expenses by selling on consignment. Working with a reliable and trustworthy international distributor or a third-party logistics provider is essential for consignment export success.

In this article, SmartOSC showed you that trade finance technology is a new term for a combination of the most cutting-edge tools for improving and automating the provision of financial services. By facilitating more simple digital financial transactions that don’t need the use of a conventional bank, it has altered the methods by which we save, borrow, and invest money. Please contact us if you have any questions! Thank you for reading.