Get inspired by this digital transformation in banking case study

Customers in every business want prompt, digital-first help as the world becomes more and more digital. All organizations, including banks, have been pushed to alter and develop with the times, as this compendium of case studies on digital transformation in banking demonstrates.

In this article, SmartOSC Fitech will introduce you to digital transformation in banking case study to get inspiration for your bank.

Core Banking Case Study: Digital Transformation in Financial Services

Problem: User Experience Is Ruined by Outdated Core Banking System Design

The fact that fundamental banking back-office systems are a major source of issues is well acknowledged but kept a secret. The banks themselves are frequently ashamed of the antiquated solutions that contrast with their sleek appearance.

An obsolete financial back office system has a bigger influence than it initially appears to have. As a result, even while digital transformation in banking case study may appear sophisticated, a dearth of human-centered solutions frequently has a detrimental effect on internal culture.

Solution: Disrupt the banking sector to save it

A solution that would take into account all bank employees’ pain points, needs, and daily tasks in order to make their work simpler, more enjoyable, and more meaningful from the perspective of banking end-customers.

Mobile Banking Case Study: Luxury Banking App UI / UX Design

Luxury Banking App User Interface Design Honored by Renowned Awards

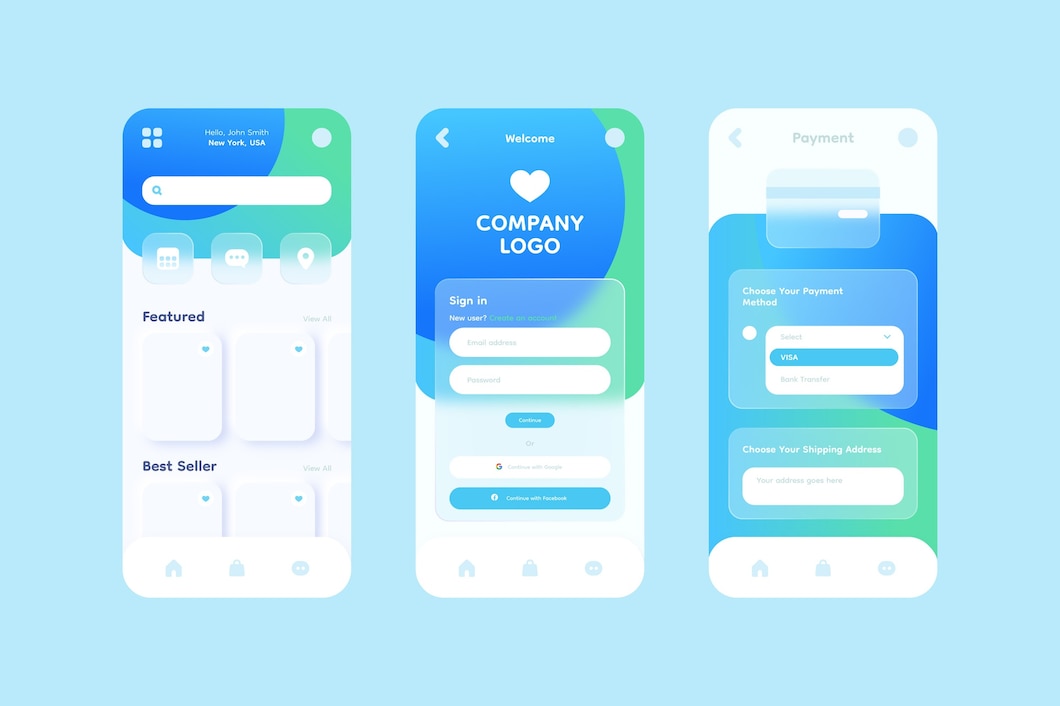

What if you put a lot of pressure on your clients to love your mobile banking app? As a consequence, customers would likely become much more enthusiastic and trustworthy. To do that, you must comprehend the users of digital transformation in banking case study and consider the globe from their perspective.

Giải pháp của SmartOSC Fintech BACKBASE DIGITAL BANKING, BUY NOW PAY LATER, LOS, CDP, EKYC, DIGITAL ONBOARDING

While maintaining well-known standards for user-friendliness that are typical of mobile designs, the UX specialists of the UXDA sought to alter some of the widely used techniques of designing mobile banking apps.

How to Create a Luxury Banking App UI / UX Design\

Create a Map of Banking App User Journey

With regard to business objectives, KPIs, and an action plan, the purpose was to understand the substance of what the consumers were expecting from the digital transformation in banking case study, as well as the sentiments they would have when using it.

Match the users’ mental models to the service conceptual models

Following that, we were able to create the information architecture of the banking app based on the mental models of user perception, allowing users to quickly comprehend the layout and guiding principles of our product.

To achieve this, it was beneficial to use a practice called ‘Card Sorting’, in which potential users are asked to arrange components of a product according to the specifics of their mental model.

Transform User Scenarios Into User Flows

The purpose of the user flows is to set the proper sequence for the crucial user situations that have been chosen in the earlier stages. It is beneficial to plan and modify the steps that users must follow to complete each activity in order to reach their objectives.

TPBank accelerates digital transformation with Backbase

About TPBank

On May 5, 2008, Tien Phong Commercial Joint Stock Bank (TPBank) was established. Its strategic shareholders, which include the DOJI Gold & Gems Group, FPT Group, Vietnam National Reinsurance Corporation (Vinare), SBI Ven Holding Pte. Ltd. (Singapore), IFC International Finance Company (under the World Bank), and PYN Elite Fund, TPBank inherits technological know-how and financial sturdiness.

TPBank collaborates with other important partners, demonstrating the bank’s long-term goals and a plan for sustainable development. Consolidate the branch system over time until there are 3 million distinct clients overall and almost 300 points of transaction across the country.

About Backbase

A financial technology business called Backbase is on a quest to redesign digital transformation in the banking case study so that the client comes first. With the help of our white-label Engagement Banking platform, banks and credit unions can quickly digitize their operations that interact with customers and design streamlined experiences that meet and surpass the demands of today’s tech-savvy consumers.

Banks and credit unions may refocus their operations on their clients by using Backbase from SMARTOSC Fintech.

The growing necessity for digital transformation in banking case study cannot be ignored. Please get in touch with us to acquire the finest information so you can create an efficient and future-proof digital transformation plan.