Understanding open finance as the next level open banking

As we become more familiar with open banking, another buzzword has emerged: open finance. So, what is open finance? Why is open finance the next step open banking?

The goal was to encourage greater competition in the financial services market, boost product innovation, enable customers to make more informed financial decisions, and encourage consumers to exercise greater control over how their data is managed.

Open Banking has established the rules and foundation for the data-sharing model between banks and approved third-party providers. Companies can now develop new innovative and personalized financial products and services by leveraging financial data and Open Banking (first and foremost with customer consent).

Let’s look at how Open finance is expected to transform Open banking.

The relationship between open finance and open banking

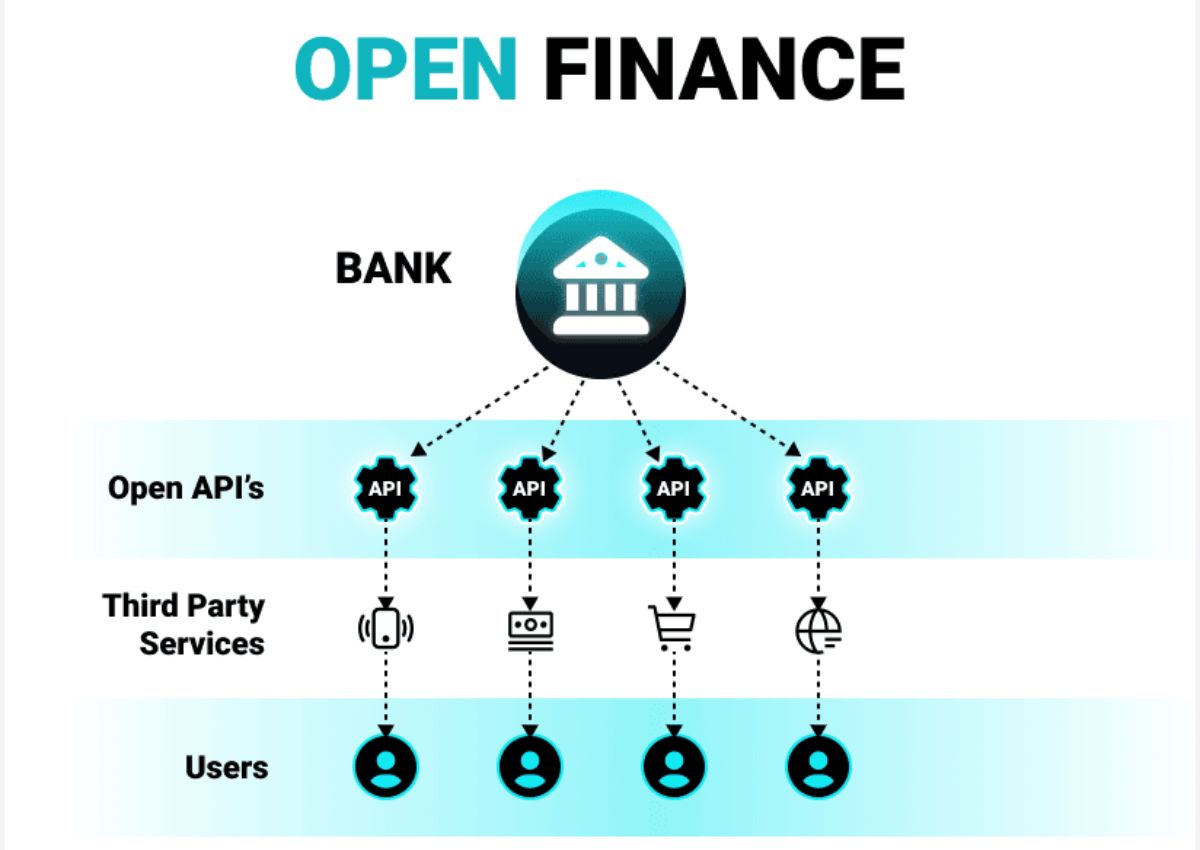

Open banking is a strategy in which third-party financial service providers use APIs to gain access to a bank’s customer data.

So, how exactly does open banking work? Simply put, this is how banks share information about their customers’ transactions with third parties, allowing them to develop more personalized and use-case-tailored offers.

Smartosc solutions : BACKBASE DIGITAL BANKING, BUY NOW PAY LATER, LOS, CDP, EKYC, DIGITAL ONBOARDING

However, the data that banks share under an open banking concept is rather limited – it does not extend beyond financial transactions made through the bank’s app or in a branch office.

In turn, open finance proposes centralizing all of the users’ financial data, including but not limited to bank transactions, digital wallet spending, insurance and retirement accounts, investments, money transfers, and crypto transactions.

As a result, open finance is the next stage of open banking development. While the benefits of open banking are limited because it allows third-party providers to access only a small portion of the data generated by customers, the benefits of open finance provide them with a complete and data-driven picture.

Why is Open Finance the next level Open Banking?

The future of open banking is expected to be open finance. It transforms and leverages the benefits of open banking by incorporating the following values for each party:

Lenders and customers can both benefit from transparency

For both lenders and borrowers, open finance promises greater transparency. The latter have the opportunity to improve their credit score without being limited to the financial data that their bank has, but rather by taking into account all of their income and spending data. The same opportunity benefits lenders because it allows them to make less risky lending decisions by predicting the probability of seamless pay-offs with the help of AI.

Increased data volume

Financial institutions, insurance companies, fintech organizations, and banks will be able to collect massive amounts of data about users’ spending habits thanks to open finance. In turn, AI-powered data analysis will allow for even more accurate suggestions on services that customers may require, as well as capturing and analyzing spending trends, anticipating needs, and assisting users in making more profound financial decisions.

Better data management

The fundamental concept of open finance is the right of customers to choose which data and which companies to share with. The use of APIs to implement open finance suggests leveraging stronger authentication mechanisms and access control systems, allowing for improved data security.

Services are being centralized

Open finance combines all of the financial services that customers use in a single location. This is an option for them to manage all of their financial accounts and transactions in one location, saving time and effort.

Conclusion

Open banking has democratized and transformed finance as we know it. Open finance is the next step in this journey, and it will encourage collaboration between third-party providers and the traditionally closed financial industry.

Open finance will benefit both businesses and individuals: consumers will have easier access to their financial data and will learn more about their finances. More information leads to better financial decisions.

Don’t forget to follow us to read more useful articles and contact SmartOSC Fintech for more advice on technology issues.