Machine learning use cases in banking

The financial services sector is progressing thanks to machine learning in banking application cases in banking. Financial institutions can now turn the unending stream of data they regularly produce into useful insights for everyone, from the C-suite and operations to marketing and business development, thanks to new cutting-edge solutions.

Machine learning fraud detection

The advanced cyber assaults and exploits are resisted by banks with antiquated equipment and weak security procedures. Businesses must make sure they are knowledgeable about fraud prevention to at least keep one step ahead of the scammers.

One of technology’s most potent uses to date is machine learning in banking for fraud prevention. To identify security concerns and probable fraud situations, specialized cutting-edge algorithms examine millions of data points, transaction characteristics, and customer behavior patterns in real-time.

In order to avoid any extra losses, machine learning helps financial firms swiftly and accurately identify fraudulent actions. As shown by a recent fraud detection case study, machine learning may hold the key to resolving the issue of false positives.

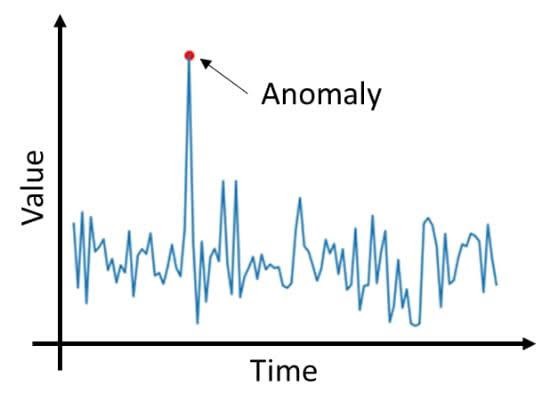

Using machine learning to find anomalies

Financial institutions must make sure they are in compliance with the stringent rules as governments continue to take action against fraud in order to avoid suffering big losses.

Banks can reliably identify the extremely subtle and often concealed events and correlations in user behavior that may indicate fraud thanks to machine learning in banking in anti-money laundering.

Smartosc solutions : BACKBASE DIGITAL BANKING, BUY NOW PAY LATER, LOS, CDP, EKYC, DIGITAL ONBOARDING

Onboarding and document processing using machine learning

Beyond transactions and fraud detection, machine learning in banking use cases in fintech provides other advantages. With remarkable success, the technology may also be used for back-office activities.

Machine learning algorithms can digitize the text on scanned documents to read, interpret, and evaluate their context after passing them through the Optical Character Recognition (OCR) procedure first.

The machine learning model may categorize the document based on that data and index it for future searches so that corporate personnel can easily access it.

Credit rating using machine learning

With the present computing capabilities, machine learning in banking in the credit card business and beyond can analyze enormous volumes of consumer data to provide accurate credit ratings very instantly and automatically.

Banks may allow their clients to personalize their loans on their own and obtain money in just a few clicks from the comfort of their homes thanks to processed data and thorough risk profiles.

Machine learning in payments

The use of machine learning in payment processing provides several benefits for the payments sector. Applying the technology to expenses, conversion, connection, Payments helps payment providers lower transaction costs and draw in more customers.

Due to their adaptability, machine learning in banking applications in finance enables businesses to create substantial value by addressing common problems.

Machine learning in process automation

Another successful use of machine learning in the FinTech industry is process automation. Finance businesses may entirely replace time-consuming manual labor and produce more value in the process by automating repetitive operations using robotic process automation, such as document processing and staff training gamification.

Machine learning in banking algorithms have a ton of data to deal with since every online activity leaves a digital trail that can be used to understand behavior and spot trends. This is particularly helpful for customer care systems that can automatically categorize, focus on, and perhaps resolve client issues.

Payments, finance, and banking use cases for machine learning put pressure on rival businesses to provide quicker, more affordable, and superior products. Machine learning in banking isn’t merely the future for more and more financial institutions.

Contact SmartOSC right immediately if you need assistance keeping up with shifting financial trends. With the use of machine learning, companies can remain competitive and be prepared for the future thanks to the expertise of our staff.