Is back-office automation really possible in banks?

Even though the vast majority of banks have purportedly “automated” their back-office processes by using industry-standard core platforms, such processes are anything but automatic. This degree of back-office automation has been attained by many factories for many years. Now banks are able to accomplish the same thing, or at least they can work toward doing so.

Breaking Down the Bank’s Back Office

The easiest area for automation in any bank is the back-office automation. In this piece, we’ll categorize it into “buckets” based on its purpose and its potential for allowing bots. But why aren’t today’s banks fully automated, you may be asking.

It’s a wise inquiry. Even though the typical bank today offers prospects for over 300 robots, the majority of banks that declare “bot success” only reach a maximum of about 10 robots. Three hundred, indeed! (Perhaps more.)

The quick response is that you must first decide whether scenarios call for bots. It’s not always easy to see them. Also required are not-friendly use-cases. If not, they must be corrected.

Why, for instance, would you allow a consumer to request an address change in a free-form text field? If you make the form’s fields consistent and include back-office automation lock-outs to stop incomplete submissions, a bot can easily navigate it.

Back-Office Process “Factories” for RPA

The back-office automation of today’s banks resembles a jumble of little “factories” that demand to be automated. They consist of:

Smartosc solutions : BACKBASE DIGITAL BANKING, BUY NOW PAY LATER, LOS, CDP, EKYC, DIGITAL ONBOARDING

Operation of deposits

This contains a sizable “long tail” of transactions, such as Reg. D letters, hot cards, etc. It is sometimes referred to as “bank operations.” The “long tail” may be absurdly lengthy, yet in the majority of institutions, the top four to six transactions make up more than half of all labor!

Risk/Compliance

Back-office automation personnel are often overburdened by the processing of Reg. E letters alone, leaving them with no “free time” to look into the factors that contribute to this danger.

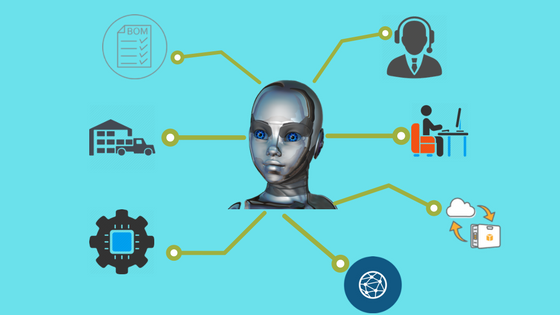

Customer Contact

Let robots do the grunt labor so that people can find and fix the fundamental issues (by working with the risk organization, which often lacks the detailed knowledge to run it down themselves).

Breaking Down the Back Office RPA Bots

Therefore, the following list of bot types may increase back-office automation productivity by lowering operational “drag” and improving productivity “lift.”

Keep in mind that there are 300 robot positions available in the typical bank. So, consider this only a little introduction to whet your appetite.

Operating leverage/high-volume bots

These machines manage tasks whose volume may change depending on factors such as bank performance (organic growth), acquisition activity, product development and marketing (promotions), market circumstances, and more. Examples comprise:

Processing Debit Card Fraud through RPA. In only three weeks, one of back-office automation that was implemented saved the company more than 1,400 hours of staff work and money.

“Refer-A-Friend” Asking Bots. Input increases when a promotion like this is made public. Why not hire more people? Why overwork the current staff? Just leave a bot in place for this transaction.

In fintech, back-office automation is not science fiction. It’s a fact of life. The best part is that any bot mentioned above may be set up at a distant location. SmartOSC will be happy to provide further information upon request. If you need help right now, please get in touch with us so that we can direct you to our consultation page; we will get back to you as soon as possible.